Currently, for Daily Paid employees, the system does not assume the basic pay for the remaining days for the year if the 13th Month will be processed in advance.

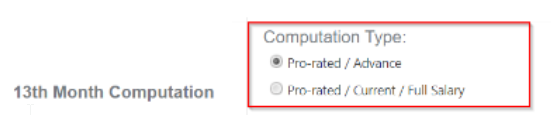

If you are going to process the 13th-month pay for daily paid Employees, the recommended set-up for them is “Pro-rated / Advance”. With that, the computation is based on the actual processed payroll only for the daily paid employees, divided by 12 months.

However, if you want to process the manually computed 13th month pay for them, here's the step-by-step guide on how to do this in payroll:

Step 1. Manually compute for the 13th Month by getting the YTD compensation of employee / 12 months.

You may generate the Year-To-Date report to get the salaries of the employees. Here's the KB article as a guide: How to Generate Year To Date Report in Sprout Payroll

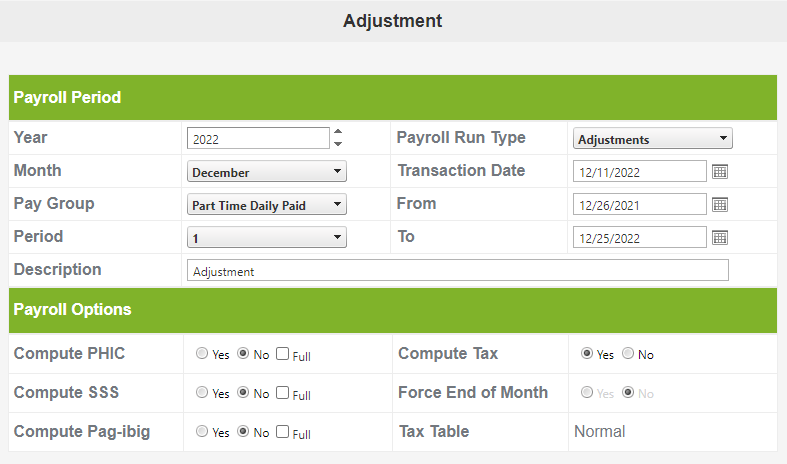

Once you are able to arrive with the total 13th Month Pay for each employee, this will be processed now via Adjustment Run.

Step 2. Create an Adjustment Run. Here's the KB article: How to Upload YTD using Adjustment Run

You have to upload the values and classify the non-taxable and taxable in the template.

IMPORTANT NOTES:

- If 13th Month Non-Taxable - Is Taxable and Apply Tax Before should be No. But if 13th Month Taxable - Is Taxable and Apply Tax Before should be Yes. Here’s the KB article: Processing of Bonus under Adjustment Payroll Run

- If you already have the computed tax as well, you may include it in the upload template but, note that compute tax should now be tagged as “No” since you will be uploading it already.

Related articles:

How to Check the 13th Month Pay Settings

Comments

0 comments

Article is closed for comments.