Employers shall pay the 13th-month salary to eligible employees on or before December 24 of each year. It's typically paid in one lump sum, but most Employers now choose to pay it in two installments instead, usually in June and December.

Now, you may be wondering how to process the 13th-month pay of employees in two installments in Sprout Payroll?

Here's how:

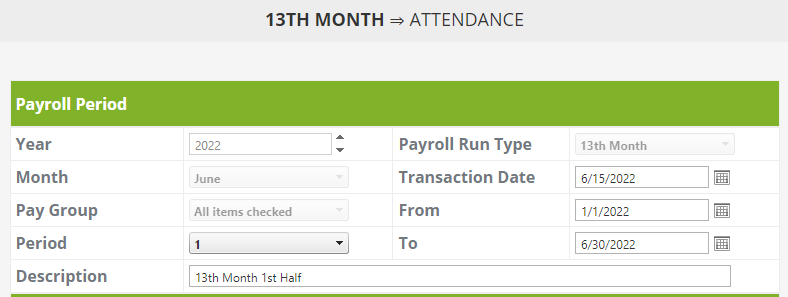

On the 13th-month payroll run set up, if you would process the First half of 13th-month pay, you can enter January to June for the period.

This setup will compute the income from January until June and will compute the prorated 13th month. Please note that if the June payroll is not yet processed, the system will assume it.

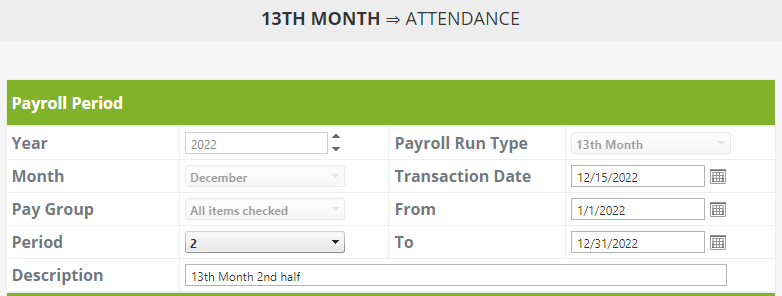

And, then on the Second half, the period to enter would be January to December.

This is to make sure that the system computes for the actual 13th month of the whole year.

What will happen in the second half process is, that the system will compute the whole 13th month of the employees for the year and then, deduct the first half that was initially given.

Please note that on the payslip and payroll register, the remaining amount, or the second half, will just appear, and there will be no presentation of deduction anymore.

Related KB articles:

How to Check the 13th Month Pay Settings

Comments

0 comments

Article is closed for comments.