A Salary Differential from SSS typically refers to the amount paid by an employer to cover the difference between an employee's regular salary and the sickness or maternity benefits received from the Social Security System (SSS).

The salary differential shall be included as part of the basic salary for purposes of computation of the 13th-month pay of the rank-and-file

employee.

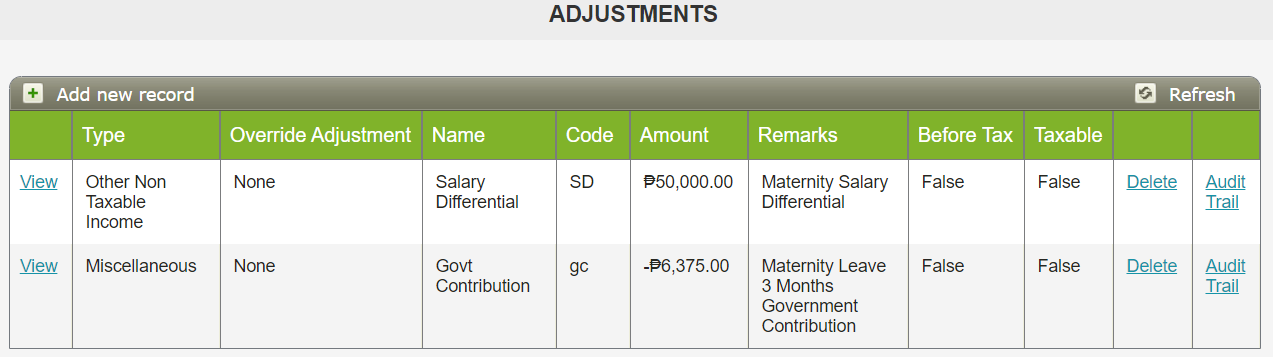

In Sprout Payroll, the Adjustment tagging or Salary differential is "Other Non Taxable income". For reference, here's how to record the Salary differential in Sprout Payroll: Maternity Leave Payroll Process

Sample:

However, the Other Non-Taxable Adjustment is not yet included in the 13th month. As a workaround, a separate adjustment run can be created. Then upload the Salary differential using the unused Adjustment type available in the 13th-month setup. To check the unused Adjustment type, YTD Report Adjustment can be generated from Sprout Payroll. How to Generate YTD Report- Adjustments in Sprout Payroll

1. Create Adjustment run. Government and Tax Should be off.

2. Upload Salary differential using the unused Adjustment type. For example, "Reimbursable allowance". This is aside from the Salary differential tagged as "Other non-taxable income. The purpose of this Adjustment is to adjustment is to include the Salary differential in 13th month computation. Then process the Payroll run.

3. Then tick the Adjustment type from the 13th month setting. How to Check the 13th Month Pay Settings

Once the Adjustment run and the 13th month setting have been all set, the 13th month can be created. How to Compute 13th Month Pay

Important note: The processed Adjustment run should be deleted after finalizing the 13th month pay.

Comments

0 comments

Article is closed for comments.