Regarding the computation, since this is a final pay for semi-monthly employees, you have two options. (1) You may convert the Basic Salary and the De Minimis (if any) from Daily Rate to Monthly Rate.

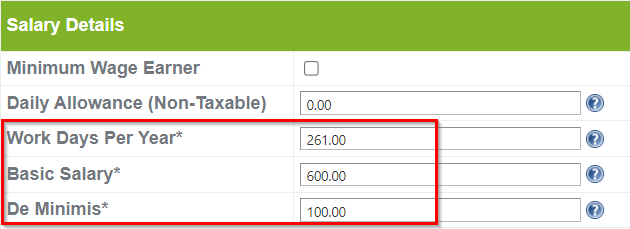

Current Daily Rate:

To convert here's the formula:

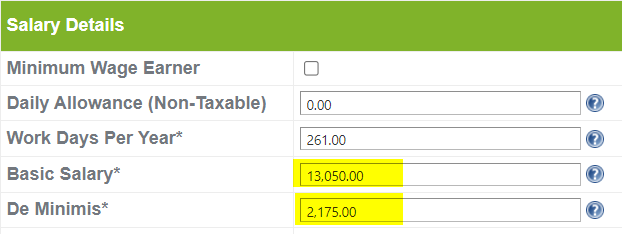

Basic Monthly Rate = (Daily Rate x Work Days Per Year)\ 12 months13,050 = (600 x 261)\12

De Minimis = (Daily Rate x Work Days Per Year)\ 12 months2,175 = (100 x 261)\12

The converted daily rate to monthly rate:

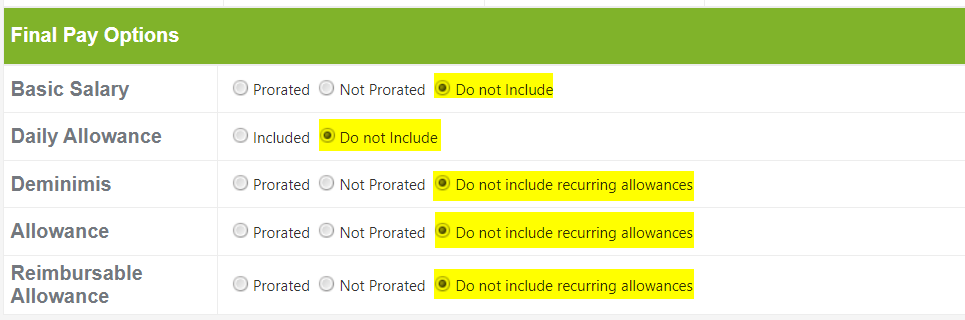

Alternatively, (2) You may set the final pay options to "Do not include." For all earnings and deductions, such as:

- Basic Pay

- Overtimes

- 13th - Month Pay

- Other Allowances

these amounts must be manually computed and uploaded via a one-time adjustment.

How to Set Up a One-Time Adjustment for a Specific Employee

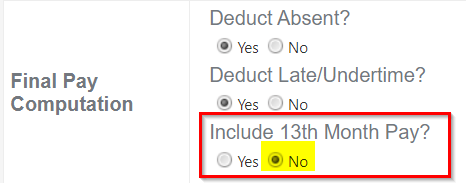

For option number 2, prior processing, make sure that the 13th-month pay is excluded or set to "No" in Final Pay computation in Setup>Company>Profile>Final Pay

For option number 2, prior processing, make sure that the 13th-month pay is excluded or set to "No" in Final Pay computation in Setup>Company>Profile>Final Pay And that's it! Final Pay of resigned Daily Paid Employees is now processed!

And that's it! Final Pay of resigned Daily Paid Employees is now processed!

Comments

0 comments

Article is closed for comments.